Tech

Nvidia CEO pushes back against report that his company’s $100B OpenAI investment has stalled

Nvidia CEO Jensen Huang said Saturday that a recent report of friction between his company and OpenAI was “nonsense.”

Huang’s comments came after The Wall Street Journal published a story late Friday claiming that Nvidia was looking to scale back its investment in OpenAI. The two companies announced a plan in September in which Nvidia would invest up to $100 billion in OpenAI and also build 10 gigawatts of computing infrastructure for the AI company.

However, the WSJ said Huang has begun emphasizing that the deal is nonbinding, and that he’s also privately criticized OpenAI’s business strategy and expressed concerns about competitors like Anthropic and Google.

In addition, the WSJ reported that the two companies are rethinking their relationship — though that doesn’t mean cutting things off entirely, with recent discussions reportedly focusing on an equity investment of a mere tens of billions of dollars from Nvidia.

An OpenAI spokesperson told the WSJ that the companies are “actively working through the details of our partnership,” adding that Nvidia “has underpinned our breakthroughs from the start, powers our systems today, and will remain central as we scale what comes next.”

According to Bloomberg, reporters asked Huang about the report during a visit to Taipei. In response, he insisted that Nvidia will “definitely participate” in OpenAI’s latest funding round “because it’s such a good investment.”

“We will invest a great deal of money,” Huang said. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.”

Techcrunch event

Boston, MA

|

June 23, 2026

He apparently declined to specify how much Nvidia would be investing, instead saying, “Let [OpenAI CEO Sam Altman] announce how much he’s going to raise — it’s for him to decide.”

The WSJ reported in December that OpenAI is looking to raise a $100 billion funding round, while The New York Times said this week that Nvidia, Amazon, Microsoft, and SoftBank are all discussing potential investments.

Tech

Spotify ventures into physical book sales, adds new audiobook features

While Spotify users face yet another price hike, book lovers have some exciting developments to look forward to that could help cushion the blow.

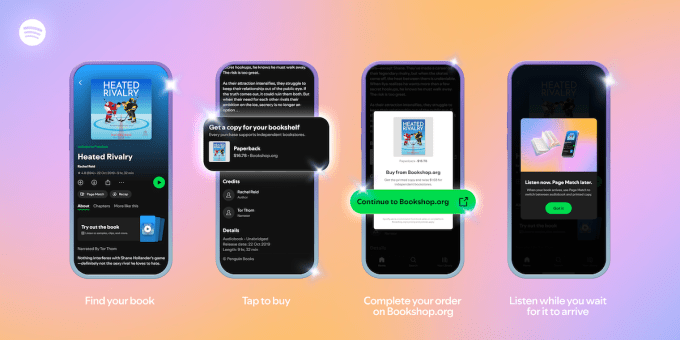

Spotify announced several updates for its audiobook business on Thursday, notably its expansion into physical books. Users in the U.S. and the UK will soon be able to purchase physical copies of their favorite audiobooks directly through the app, marking a significant pivot for the once digital-only platform.

The company also introduced two features designed to make the audiobook experience smoother and more flexible, including a new tool called “Page Match” that lets users scan a page from a physical book to instantly transition to that spot in the audiobook.

Additionally, “Audiobook Recaps”—a previously iOS-only feature—is coming to Android devices in the spring. This feature provides bite-sized recaps tailored to the last section users stopped listening to.

Spotify’s decision to sell physical books through its app positions it as a competitor to major booksellers, including Amazon and Barnes & Noble. The company also recognizes that many readers still value physical books, and by offering both print and digital formats, Spotify is trying to turn itself into a one-stop shop for book lovers.

Spotify has partnered with Bookshop.org on the new offering, an online marketplace that supports local, independent bookstores. This partnership is great news for indie booksellers, as every purchase made via Spotify will directly benefit local book communities.

The ability to purchase physical books will roll out this spring and appear on audiobook pages in the app as a button labeled “Add to your bookshelf at home.” Clicking it takes users to Bookshop’s website, which handles the pricing, inventory, and shipping.

Techcrunch event

Boston, MA

|

June 23, 2026

To bridge the gap between formats, Spotify is also launching a feature called Page Match, which is currently available to premium subscribers and will roll out to all audiobook users by late February. The feature was initially spotted by Android Authority last month.

Spotify’s new Page Match feature lets users scan a page from a physical or e-book using their phone camera. The tool analyzes the page content and directs users to the exact spot in the audiobook. It’s powered by a combination of Spotify’s in-house and third-party computer vision and image scanning technologies.

When users want to switch to the audiobook, they can select the “Scan to Listen” button and click the “Scan to Read” button to return to the physical book, making it easy for users to pick up where they left off, whether they’re reading at home or switching to audio while on the go.

Page Match is currently available for most English-language titles, with plans for future expansion. There are now more than 500,000 titles on the platform.

In the two years since Spotify first introduced audiobooks, the platform has experienced significant growth. The company reported in October that the number of users listening to audiobooks rose 36% over the past year, and listening hours increased 37%. Plus, more than half of Spotify’s 281 million premium subscribers have engaged with an audiobook.

Spotify is expected to release its fourth-quarter earnings results February 10.

Tech

Google’s subscriptions rise in Q4 as YouTube pulls $60B in yearly revenue

Alphabet-owned YouTube’s subscription and ad revenue is trending upwards. The company on Wednesday said it now has 325 million paying users across Google One and YouTube Premium, up from 300 million three months earlier.

YouTube reported ad revenue increased 9% to $11.38 billion in the fourth quarter, but missed analysts’ average estimates of $11.84 billion. YouTube’s overall revenue, including ads and subscriptions, came in at $60 billion in the full financial year, up 17% compared to a year earlier.

The company said that YouTube’s $8 per month, ad-free premium tier is seeing strong traction, but didn’t specify any numbers. It added that YouTube Premium also saw strong growth.

Alphabet CEO Sundar Pichai said the company plans to flesh out its subscription offerings, especially to capitalize on its growing YouTube TV userbase. “We’ll soon launch new YouTube TV plans, bringing more choice and flexibility to subscribers with over 10 genre-specific packages,” he said.

YouTube Shorts recorded 200 billion average daily views in the quarter, the same as last year, but in some countries, ads on short-form video earn more than in-stream ads on a per-hour basis, the company said. Pichai also highlighted podcasts as a growing format, with viewers watching 700 million hours of podcasts from their TVs in October.

YouTube said that its AI features are seeing traction, and more than 1 million channels are using its AI creation tools. The company said that 20 million consumers used its Gemini-powered content discovery tool in December.

Tech

SNAK Venture Partners raises $50M fund to back vertical marketplaces

SNAK Venture Partners announced Wednesday the close of its oversubscribed $50 million debut fund, anchored by the investment firm Pritzker Group (founded by Illinois governor JB Pritzker and his brother, Tony).

SNAK founders Sonia Nagar and Adam Koopersmith worked at the firm and helped lead investments in companies like the auto marketplace Backlot Cars and TicketsNow (exited to Ticketmaster). The duo decided to break out on their own and, earlier this year, launched their firm to back digital marketplaces.

“It felt like the timing was right and there was support within the firm to go do this,” Nagar said.

The vision is that there is still so much to digitize, like in supply chain and construction, and this is the moment to strike because even holdout industries are more comfortable adopting new technology as fintech architecture advances.

“If you look at the biggest venture wins over the last decade,” she said, pointing to the likes of Uber, Instacart, and Airbnb, “those are five of the top 10 outcomes in venture.” As in those companies that raised billions from investors, went on to IPO, and returned millions to them.

“Most of those wins were in consumer, which tends to be faster-moving than large enterprises,” Nagar continued. “We think there’s a ton of white space to double down and focus on B2B marketplaces.” Looking specifically for the categories that haven’t yet digitized.

The firm has already invested in six companies, including Big Rentals and Repackify, focused on equipment rental and packaging logistics, respectively. Nagar said the firm hopes to overall write seed checks into at least 20 companies, at $1 million to $2 million a pop. She said they hope to deploy the entire fund within the next 3 to 4 years.

Techcrunch event

Boston, MA

|

June 23, 2026

Though many new funds are struggling to raise capital (and capital remains concentrated at the top), Nagar said she and Koopersmith were able to lean on their backgrounds when wooing LPs.

Nagar previously helped launch Amazon apparel back in 2009, and was head of mobile at RetailMeNot. Koopersmith, meanwhile, spent 20 years at Pritzker Group and serves on the board of various marketplace companies. At the same time, Nagar said that without Pritzker’s support, it would have been quite hard to raise this fund, especially in last year’s environment.

Other LPs in their fund include the State of Illinois Growth and Innovation Fund and executives from other marketplace companies, like Favor Delivery and RetailMeNot.

Nagar said the firm is also location-agnostic, recognizing that the still-hidden marketplaces may not be found only in Silicon Valley and New York City. “We’re finding these overlooked founders in places where maybe other funds aren’t looking,” she said.

SNAK is itself based in Chicago, which she said some LPs have questioned. “People perceive that as a disadvantage; we view it as an advantage,” she continued. “We can get to everybody very fast.”