Tech

TikTok says its services are restored after the outage

TikTok, which is under new ownership in the U.S., said Sunday that it has restored service after outages last week that marred user experiences. The social network has over 220 million users in the U.S.

The company blamed last week’s snowstorm, which caused an outage at an Oracle-operated data center responsible for TikTok operations.

“We have successfully restored TikTok back to normal after a significant outage caused by winter weather took down a primary U.S. data center site operated by Oracle. The winter storm led to a power outage which caused network and storage issues at the site and impacted tens of thousands of servers that help keep TikTok running in the U.S. This affected many of TikTok’s core features—from content posting and discovery to the real-time display of video likes and view counts,” the company said in a post on X.

In January, the U.S. finalized the deal to create a separate entity for TikTok. A U.S.-based investor consortium called TikTok USDS took a controlling 80% stake, with the remaining 20% ownership held by ByteDance.

Following the deal finalization — which coincided with the snowstorm — users experienced glitches in features like posting, searching within the app, slower load times, and time-outs. TikTok noted that creators might see zero views on their posts until the problem was resolved. Later, the company said that it was working on solving the issue, but outages persisted, and users faced problems with posting content.

TikTok’s transition to a new ownership structure, paired with app snafus and user experience glitches, was beneficial for some other social networks. The Mark Cuban-backed short video app Skylight, which is built on the AT protocol, saw its user base soar to more than 380,000 users in the week the deal was finalized. Upscrolled, a social network by Palestinian-Jordanian-Australian technologist Issam Hijazi, also climbed in App Store rankings to reach the second spot in the social media category in the U.S. The app was downloaded 41,000 times within days of the TikTok deal’s finalization, according to analyst firm AppFigures.

Techcrunch event

Boston, MA

|

June 23, 2026

Tech

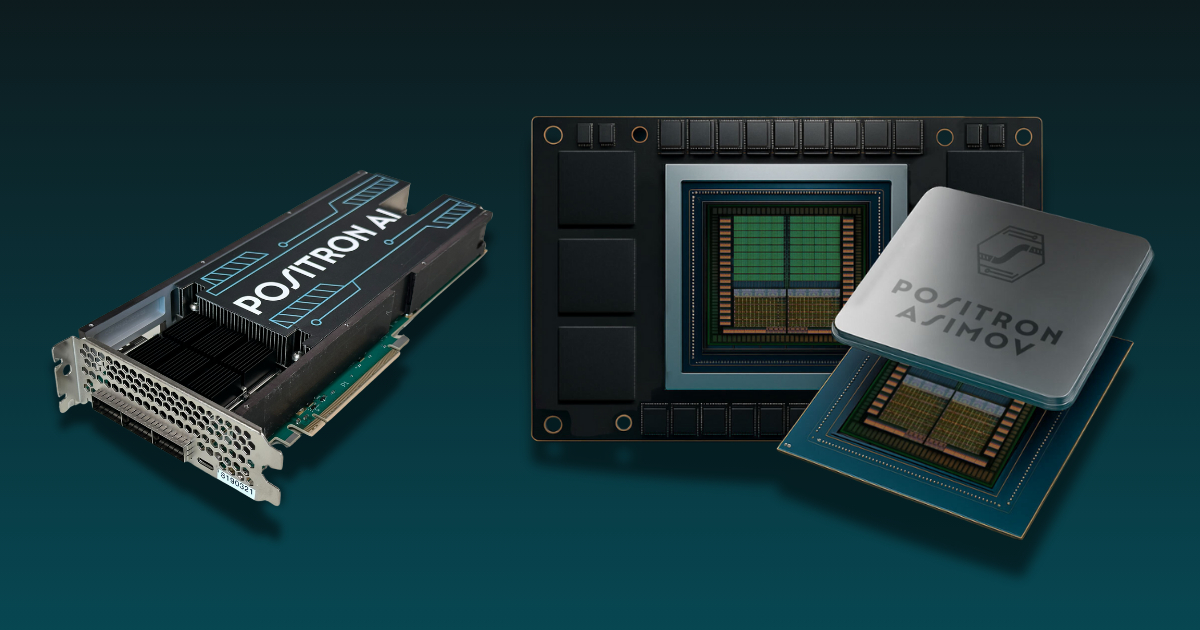

Exclusive: Positron raises $230M Series B to take on Nvidia’s AI chips

Semiconductor startup Positron has secured $230 million in Series B funding, TechCrunch has exclusively learned. The outfit plans to use the capital to speed up deployment of its high-speed memory chips, a critical component for the chips used for AI workloads, sources familiar with the matter told TechCrunch.

Investors in the round include Qatar Investment Authority (QIA), the country’s sovereign wealth fund, which has been increasingly focused on building out AI infrastructure, the sources said.

The Reno-based startup’s Series B comes as hyperscalers and AI firms push to reduce their reliance on longstanding leader Nvidia. These firms include OpenAI, which, despite being one of Nvidia’s largest and most important customers, is reportedly unsatisfied with some of the firm’s latest AI chips and has been seeking alternatives since last year.

Meanwhile, Qatar, through QIA, has been accelerating a broader push into so-called “sovereign” AI infrastructure – a priority repeatedly underscored at Web Summit Qatar in Doha this week. Several sources told TechCrunch the country views compute capacity as critical to staying competitive on the global economic stage, and is positioning itself as a leading AI services hub in the Middle East, fueling interest in startups like Positron.

The strategy is already taking shape through major commitments, including a $20 billion AI infrastructure joint venture with Brookfield Asset Management that was announced in September.

Positron’s fundraise brings the three-year-old startup’s total capital raised to just over $300 million. The startup previously raised $75 million last year from investors including Valor Equity Partners, Atreides Management, DFJ Growth, Flume Ventures and Resilience Reserve.

The company claims its first-generation chip, Atlas, manufactured in Arizona, can match the performance of Nvidia’s H100 GPUs for less than a third of the power. Positron is focused on inference – computing needed to run AI models for real-world applications – rather than training large language models, positioning the company as demand surges for inference hardware as businesses increasingly shift focus from building large models to deploying them at scale.

Techcrunch event

Boston, MA

|

June 23, 2026

Sources tell TechCrunch that beyond its memory capabilities, Positron’s chips also perform strongly in high-frequency and video-processing workloads.

TechCrunch has reached out to Positron for more information.

Tech

Peak XV says internal disagreement led to partner exits as it doubles down on AI

Peak XV Partners, a leading venture capital firm in India and Southeast Asia, has seen a fresh round of senior departures. These follow other leadership exits over the past year as it pushes ahead with plans to deepen its focus on AI investing and expand its footprint in the U.S., while keeping India as its largest market.

The latest departures stem from an internal disagreement with senior partner Ashish Agrawal (pictured above, left) that led to a mutual decision to part ways, Managing Director Shailendra Singh told TechCrunch. He added that two other partners, Ishaan Mittal (pictured above, right) and Tejeshwi Sharma (pictured above, center), chose to leave alongside him.

Singh said Peak XV did not want to go into the specifics of the disagreement and was focused on moving forward. “Just out of privacy, and out of, like, trying to be classy about it,” he said. Singh added that such departures were not uncommon at large, multi-stage venture firms and that Peak XV wanted to move on quickly after several years of working together.

All board seats held by the departing partners would be transitioned “imminently,” Singh said, noting that the firm already had overlapping representation across several portfolio companies. He said Peak XV was not concerned about continuity, noting that multiple general partners and operating partners were already involved across many of those boards.

The departures mark the exit of long-tenured investors from the firm. Agrawal had been with Peak XV for more than 13 years, while Mittal spent over nine years at the firm and Sharma more than seven years, per their LinkedIn profiles.

Agrawal wrote in a LinkedIn post that he had decided to “take the entrepreneurial plunge” and was teaming up with Mittal and Sharma to start a new venture capital firm. He described the move as an opportunity to build a new institution with longtime partners and thanked Peak XV’s leadership for what he called a “truly wonderful partnership.”

During his time at Peak XV, Agrawal led investments across fintech, consumer, and software, including Groww, one of the firm’s most prominent IPO exits in 2025. He also backed multiple early- and growth-stage companies alongside Mittal and Sharma, contributing to Peak XV’s broader portfolio build-out over the past decade.

Agrawal, Mittal, and Sharma did not respond to messages for comments.

Peak XV has also moved to strengthen its senior leadership from within. The firm on Tuesday promoted Abhishek Mohan to general partner, expanding its investment leadership bench, while Saipriya Sarangan was elevated to chief operating officer, taking charge of firm-wide operations.

The leadership changes come amid a standout year for Peak XV’s portfolio exits. Five of its companies — Groww, Pine Labs, Meesho, Wakefit, and Capillary Technologies — went public in November and December 2025, generating roughly ₹300 billion (around $3.33 billion) in unrealized, mark-to-market gains for the firm, in addition to about ₹28 billion (about $310.61 million) in realized gains from share sales during the IPOs.

In addition to the latest departures, Peak XV has seen a broader churn in its senior ranks over the past 12 months. Last year, long-time investment leaders Harshjit Sethi and Shailesh Lakhani exited the India team, while Abheek Anand and Pieter Kemps departed from the firm’s Southeast Asia operations. The firm has also seen leadership changes across its marketing, policy, and operations teams in recent months.

Singh dismissed a view circulating in the market that many of the partners who drove Peak XV’s largest exits were no longer at the firm, calling the narrative “not statistically true.” He said several of the firm’s most significant outcomes had been led by long-tenured partners who remained at Peak XV, and argued that the firm’s exit track record did not hinge on any single individual.

Peak XV currently has seven general partners, along with multiple partners and principals, according to Singh.

The VC firm, which split from Sequoia Capital in 2023 and currently manages over $10 billion in capital across 16 funds, has made about 80 investments linked to AI, Singh said, highlighting its push to deepen its focus on AI funding. It is also preparing to open a U.S. office within the next 90 days as it expands its global footprint, per Singh, while continuing to view India as its largest and most important market.

Singh stated the firm believed AI would reshape venture investing more profoundly than previous technology shifts, arguing that successful AI investing required investors with deep technical understanding rather than “generalist” experience. He added that Peak XV was looking to add more AI-native talent, including researchers and engineers with backgrounds in machine learning and large-scale model development.

The firm has invested in more than 400 companies, and its portfolio has seen over 35 initial public offerings and several M&As to date.

Tech

PayPal hires HP’s Enrique Lores as its new CEO

PayPal said on Tuesday it is hiring HP’s Enrique Lores as its CEO and president, replacing current chief executive Alex Chriss. Lores, who has been the chair of PayPal’s board since July 2024, will also take up the role of president.

PayPal said the appointment was made because the company’s pace of change and execution was “not in line with the Board’s expectations” given broader market trends.

Chriss joined PayPal in September 2023 from Intuit, succeeding Dan Schulman. PayPal’s CFO and COO, Jamie Miller, will take over as interim CEO until Lores joins the company.

The appointment comes as PayPal on Tuesday reported lower than expected revenue and profit in the fourth quarter, as consumer spending dipped amid a broader cost of living crisis and a softening labor market. The company also forecast a dip in its full-year profit, which surprised investors, as Wall Street had broadly expected the company to forecast growth instead.

PayPal’s shares were down about 17.9% in premarket trading on Tuesday.

Lores, who served as president and CEO of HP for over six years, said that apart from product innovation, PayPal will hold itself accountable for delivering quarterly accounts.

“The payments industry is changing faster than ever, driven by new technologies, evolving regulations, an increasingly competitive landscape, and the rapid acceleration of AI that is reshaping commerce daily. PayPal sits at the center of this change, and I look forward to leading the team to accelerate the delivery of new innovations and to shape the future of digital payments and commerce,” Lores said in a statement.

Techcrunch event

Boston, MA

|

June 23, 2026