Tech

Guys, I don’t think Tim Cook knows how to monetize AI

Apple exceeded expectations when it reported its quarterly earnings on Thursday, revealing that it made $143.8 billion in revenue for a 16% year-over-year increase. As analysts peppered CEO Tim Cook with softball questions during Apple’s earnings call, one analyst dared to ask the question that seemingly no one in Silicon Valley is willing to ask.

“When I think about your AI initiatives, you know, it’s clear there are added costs associated with that… Many of your competitors have already integrated AI into their devices, and it’s just not clear yet what incremental monetization they’re seeing because of AI…,” started Morgan Stanley’s Erik Woodring.

Could there be a tinge of nervousness underneath this Finance Man’s probably-very-financey facade? In what I can only imagine must have been a Herculean display of courage, Woodring asked the question that lurks only in the darkest, dampest recesses of investors’ minds.

“So, how do you monetize AI?” he asked.

You’d think this would come up more. You would be wrong. Instead, Big Tech has taken a largely vibes-driven approach to AI development. Take OpenAI, for instance, which may seem like it’s on top of the world, given how ChatGPT has embedded itself into the cultural consciousness. But the company isn’t planning to make any money until 2030. Analysts from HBSC are even doubtful about that timeline, especially since it will need another $207 billion in funding, estimates say. Ask anyone in tech how OpenAI is planning to break even, and you’ll be met with the verbal equivalent of the ¯_(ツ)_/¯ emoticon.

But good ol’ Tim “$143.8 billion in revenue” Cook was having a good afternoon, so maybe he’d finally spill the beans about how any of these companies are planning to recoup their investments.

His answer was disappointing.

“Well, let me just say that we’re bringing intelligence to more of what people love, and we’re integrating it across the operating system in a personal and private way, and I think that by doing so, it creates great value, and that opens up a range of opportunities across our products and services,” Cook said.

So, there you have it, folks. Apple will monetize AI by creating “great value.” And, crucially, that will “open up a range of opportunities.” Which we will experience in “products and services.” Cool!

Well, shout out to that Morgan Stanley guy for trying.

Tech

The kids ‘picked last in gym class’ gear up for Super Bowl

The Super Bowl is happening in Silicon Valley this Sunday, and the Patriots-Seahawks game at Levi’s Stadium is going to be packed with tech money. YouTube CEO Neal Mohan is expected to be there. Apple’s Tim Cook, too. (He has become a Super Bowl fixture since Apple Music began sponsoring the halftime show several years ago.)

Longtime VC Venky Ganesan from Menlo Ventures gave the New York Times a quote about the whole thing, saying the Super Bowl in the Bay Area is “tech billionaires who got picked last in gym class paying $50,000 to pretend they’re friends with the guys who got picked first.” Added Ganesan, “And for the record, I, too, was picked last in gym class.”

Ganesan could likely afford a $50,000 ticket if he needed one. Menlo went all-in on Anthropic, setting up a $100 million fund with the AI company in summer 2024 to invest in other AI startups. The firm has also joined numerous funding rounds for Anthropic itself, both through its flagship fund and various special purpose vehicles. (Anthropic is reportedly expected to close a $20 billion round of funding next week at a post-money valuation of $350 billion.)

Tickets are expensive across the board, averaging almost $7,000 according to the Times (with some last-minute seats still available on StubHub for closer to $3,600, according to a quick glance at the ticket reseller site). Only a quarter go to the general public; the rest are distributed to NFL teams. Of all ticket buyers, the largest group (27%) is coming from Washington State for the Seahawks, who’ve won just one Super Bowl in franchise history compared with the Patriots’ six titles, all with Tom Brady at quarterback.

Google, OpenAI, Anthropic, Amazon, and Meta are splashing out for competing ads about whose AI is best for customers, so maybe their respective CEOs will show up, too. Other than Amazon’s Andy Jassy, who reportedly splits his time between Seattle and Santa Monica, all of them have homes within an hour or so of Sunday’s game.

This is just the third time the Bay Area has hosted the Super Bowl. The first time was in 1985 at Stanford Stadium, the original football stadium at Stanford University, where the 49ers beat the Dolphins. The second took place 10 years ago at Levi’s Stadium, when the Broncos beat the Panthers.

Techcrunch event

Boston, MA

|

June 23, 2026

Tech

India has changed its startup rules for deep tech

Deep tech startups in sectors such as space, semiconductors, and biotech take far longer to mature than conventional ventures. Because of that India is adjusting its startup rules, and mobilizing public capital, hoping to help more of them make it to commercial products.

This week, the Indian government updated its startup framework, doubling the period for which deep tech companies are treated as startups to 20 years and raising the revenue threshold for startup-specific tax, grant, and regulatory benefits to ₹3 billion (about $33.12 million), from ₹1 billion (around $11.04 million) previously. The change aims to align policy timelines with the long development cycles typical of science- and engineering-led businesses.

The change also forms part of New Delhi’s effort to build a long-horizon deep tech ecosystem by combining regulatory reform with public capital, including the ₹1 trillion (around $11 billion) Research, Development and Innovation Fund (RDI), announced last year. That fund is intended to expand patient financing for science-led and R&D-driven companies. Against that backdrop, U.S. and Indian venture firms later came together to launch the India Deep Tech Alliance, $1 billion-plus private investor coalition that includes Accel, Blume Ventures, Celesta Capital, Premji Invest, Ideaspring Capital, Qualcomm Ventures, and Kalaari Capital, with chipmaker Nvidia acting as an adviser.

For founders, these changes may fix what some see as an artificial pressure point. Under the previous framework, companies often risked losing startup status while still pre-commercial, creating a “false failure signal” that judged science-led ventures on policy timelines rather than technological progress, said Vishesh Rajaram, founding partner at Speciale Invest, an Indian deep tech venture capital firm.

“By formally recognizing deep tech as different, the policy reduces friction in fundraising, follow-on capital, and engagement with the state, which absolutely shows up in a founder’s operating reality over time,” Rajaram told TechCrunch.

Still, investors say access to capital remains a more binding constraint, particularly beyond the early stages. “The biggest gap has historically been funding depth at Series A and beyond, especially for capital-intensive deep tech companies,” Rajaram said. That is where the government’s earlier RDI fund is meant to play a complementary role.

“The real benefit of the RDI framework is to increase the funding available to deep tech companies at early and growth stages,” said Arun Kumar, managing partner at Celesta Capital. By routing public capital through venture funds with tenors similar to private capital, he said, the fund is designed to address chronic gaps in follow-on funding without altering the commercial criteria that govern private investment decisions.

Techcrunch event

Boston, MA

|

June 23, 2026

Siddarth Pai, founding partner at 3one4 Capital and co-chair of regulatory affairs at the Indian Venture and Alternate Capital Association, said India’s deep tech framework avoids a “graduation cliff” that has historically cut companies off from support just as they scale.

These policy changes come as the RDI fund is beginning to take shape operationally, Pai said, with the first batch of fund managers identified and the process of selecting venture and private equity managers under way.

While private capital for deep tech already exists in India — particularly in areas such as biotech — Pai told TechCrunch the RDI Fund is intended to act as a nucleus around which greater capital formation can occur. Unlike a traditional fund-of-funds, he noted, the vehicle is also designed to take direct positions and provide credit and grants to deep tech startups.

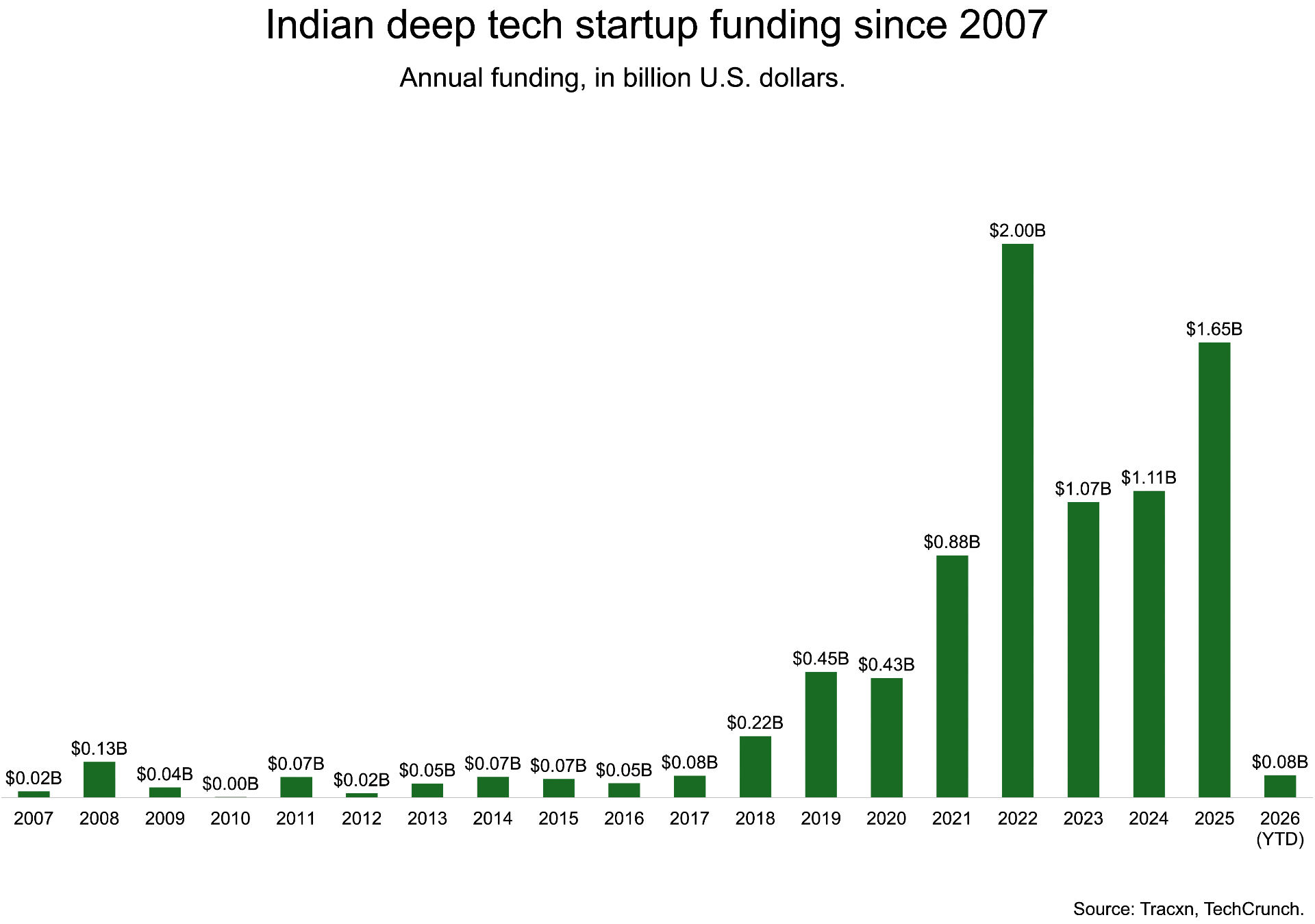

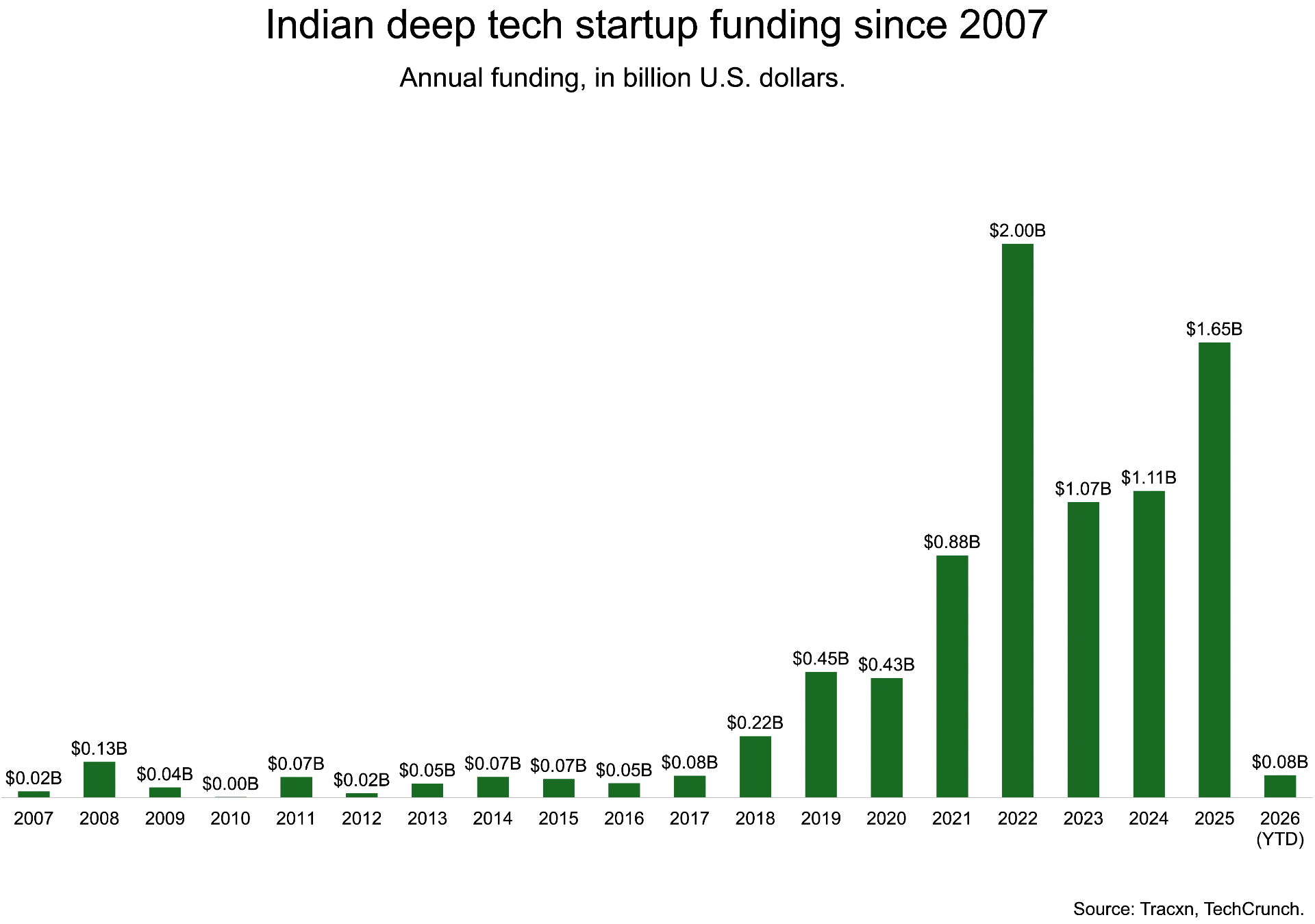

India’s deep tech funding grows

In terms of scale, India remains an emerging rather than dominant deep tech market. Indian deep tech startups have raised $8.54 billion in total to date, but recent data point to renewed momentum. Indian deep tech startups raised $1.65 billion in 2025, a sharp rebound from $1.1 billion in each of the previous two years after funding peaked at $2 billion in 2022, per Tracxn. The recovery suggests growing investor confidence, particularly in areas aligned with national priorities such as advanced manufacturing, defence, climate technologies, and semiconductors.

“Overall, the pickup in funding suggests a gradual move toward longer-horizon investing,” said Neha Singh, co-founder of Tracxn.

In comparison, U.S. deep tech startups raised about $147 billion in 2025, more than 80 times the amount deployed in India that year, while China accounted for roughly $81 billion, data from Tracxn shows.

The disparity highlights the challenge India faces in building capital-intensive technologies, even with its wealth of engineering talent. So the hope is that these moves by the Indian government will lead to more investor participation over the medium term.

A longer-term signal

For global investors, New Delhi’s framework change is being read as a signal of longer-term policy intent rather than a trigger for immediate shifts in allocation. “Deep tech companies operate on seven- to twelve-year horizons, so regulatory recognition that stretches the lifecycle gives investors greater confidence that the policy environment will not change mid-journey,” said Pratik Agarwal, a partner at Accel. While he said the change would not alter allocation models overnight or eliminate policy risk entirely, it increased investor comfort that India is thinking about deep tech on longer time horizons.

“The change shows that India is learning from the U.S. and Europe on how to create patient frameworks for frontier building,” Agarwal told TechCrunch.

Whether the move will reduce the tendency of Indian startups to shift their headquarters overseas as they scale remains an open question.

The extended runway strengthens the case for building and staying in India, Agarwal said, though access to capital and customers still matters. Over the past five years, he added, India’s public markets have shown a growing appetite for venture-backed tech companies, making domestic listings a more credible option than in the past. That, in turn, could ease some of the pressure on deep tech founders to incorporate overseas, even if access to procurement and late-stage capital will continue to shape where companies ultimately scale.

For investors backing long-horizon technologies, the ultimate test will be whether India can deliver globally competitive outcomes. The real signal, Kumar of Celesta Capital said, would be the emergence of a critical mass of Indian deep tech companies succeeding on the world stage.

“It would be great to see ten globally competitive deep tech companies from India achieve sustained success over the next decade,” he said, describing that as the benchmark he would look for in assessing whether India’s deep tech ecosystem is maturing.

Tech

New York lawmakers propose a three-year pause on new data centers

New Yorker state lawmakers have introduced a bill that would impose a moratorium of at least three years on permits tied to the construction and operation of new data centers. While the bill’s prospects are uncertain, Wired reports that New York is at least the sixth state to consider pausing construction of new data centers.

As tech companies plan to spend ever-increasing amounts of money to build AI infrastructure, both Democrats and Republicans have expressed concerns about the impact those data centers might have on surrounding communities. Studies have also linked data centers to increased home electricity bills.

Critics include progressive Senator Bernie Sanders, who has called for a national moratorium, as well as conservative Florida Governor Ron De Santis, who said data centers will lead to “higher energy bills just so some chatbot can corrupt some 13 year old kid online.”

More than 230 environmental groups including Food & Water Watch, Friends of the Earth, and Greenpeace recently signed an open letter to Congress calling for a national moratorium on the construction of new data centers.

Eric Weltman of Food & Water Watch told Wired that the New York bill — sponsored by state senator Liz Krueger and assemblymember Anna Kelles, both Democrats — was “our idea.” Data center pauses have also been proposed by Democrats in Georgia, Vermont, and Virginia, while Republicans sponsored similar bills in Maryland and Oklahoma.

According to Politico, Krueger described her state as “completely unprepared” for the “massive data centers” that are “gunning for New York.”

“It’s time to hit the pause button, give ourselves some breathing room to adopt strong policies on data centers, and avoid getting caught in a bubble that will burst and leave New York utility customers footing a huge bill,” she said.

Techcrunch event

Boston, MA

|

June 23, 2026

Last month, New York Governor Kathy Hochul announced a new initiative called Energize NY Development, which her office said would both modernize the way large energy users (i.e., data centers) would connect to the grid while also requiring them to “pay their fair share.”