Tech

Meet the new European unicorns of 2026

January was such a long month that it has already brought us five fresh European unicorns: from Belgium to Ukraine, several tech startups raised funding at valuations above the $1 billion threshold.

But before we take a closer look at who joined the club, two caveats.

First: This count includes startups that may be incorporated elsewhere but have their roots or a large part of their team in Europe. Until a pan-European corporate structure exists (often called “EU Inc”), this split will remain common — and we’ve decided to overlook it. Take Lovable, which is incorporated in Delaware but cannot be dissociated from Stockholm’s startup scene.

Second: valuation doesn’t equal commercial success, and it is too early to tell whether all of these companies will achieve the kind of traction that Lovable has, with the company recently crossing $300 million in annual recurring revenue. But in the current climate, the fact that VCs were willing to invest in them at unicorn valuations is a strong signal of where the appetite is.

With these caveats out of the way, let’s dive in.

Aikido

Belgium-based cybersecurity startup Aikido Security reached unicorn status with its $60 million Series B funding round. Valuing the company at $1 billion, the round was led by DST Global, with participation from PSG Equity, Singular, Notion Capital, and others.

According to a press release, the funding will help Aikido enhance its platform, which was built to unify security across the entire software lifecycle and is already used by more than 100,000 teams globally. The company also reported “five-times revenue growth and nearly three-times customer growth” over the last year.

Techcrunch event

Boston, MA

|

June 23, 2026

In a blog post, the startup celebrated this milestone and its significance. According to its team, “in an industry dominated by Palo Alto and Tel Aviv heavyweights, Aikido shows that Europe can build a world-class software security company and win globally.”

Cast AI

Cloud optimization company Cast AI is headquartered in Florida, but has Lithuanian roots and a major office in Vilnius — which explains why many now consider it to have become Lithuania’s fifth unicorn.

Cast AI’s valuation now exceeds $1 billion following a strategic investment from Pacific Alliance Ventures (PAV), the U.S.-based corporate venture arm of Korean conglomerate Shinsegae Group. In April 2025, Cast AI raised a $108 million Series C that had reportedly already brought the company close to unicorn territory.

Alongside its latest funding round, the company also introduced OMNI Compute for AI, which aims to help users deploy more AI workloads on fewer GPUs and remove regional capacity constraints.

Harmattan AI

French defense tech company Harmattan AI was only founded in 2024, but is already worth $1.4 billion, according to its latest funding round. The $200 million Series B was led by Dassault Aviation, maker of the Rafale fighter jets, and also ties into a broader partnership.

Before securing this key partner, Harmattan AI had already signed agreements with the French and British ministries of defense and with Ukrainian drone maker Skyeton, amid growing appetite for autonomous defense aircraft.

Osapiens

German ESG software firm Osapiens raised a $100 million Series C led by Decarbonization Partners, a joint venture between BlackRock and Temasek, which valued the company at over $1.1 billion.

Founded in Mannheim in 2018, Osapiens now has more than 2,400 customers worldwide, including large multinational companies that rely on its platforms and tools for sustainability reporting and data compliance, but also to mitigate supply chain risks.

Preply

The 14-year-old language learning marketplace Preply is now a unicorn valued at $1.2 billion — a milestone that also embodies Ukrainian resilience. The edtech company was founded in the United States, but its founders are Ukrainian and supporters of their home country, where Preply has a team of 150 employees.

According to its CEO, Kirill Bigai, who believes in AI-enhanced learning, proceeds from the $150 million Series D round will help the startup hire more AI talent across its four offices — now located in Barcelona, London, New York, and Kyiv.

Tech

Spotify ventures into physical book sales, adds new audiobook features

While Spotify users face yet another price hike, book lovers have some exciting developments to look forward to that could help cushion the blow.

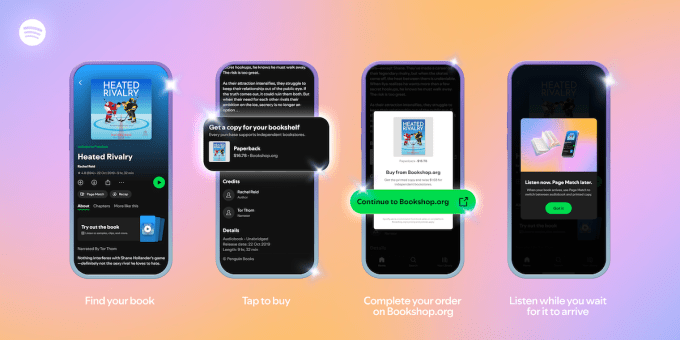

Spotify announced several updates for its audiobook business on Thursday, notably its expansion into physical books. Users in the U.S. and the UK will soon be able to purchase physical copies of their favorite audiobooks directly through the app, marking a significant pivot for the once digital-only platform.

The company also introduced two features designed to make the audiobook experience smoother and more flexible, including a new tool called “Page Match” that lets users scan a page from a physical book to instantly transition to that spot in the audiobook.

Additionally, “Audiobook Recaps”—a previously iOS-only feature—is coming to Android devices in the spring. This feature provides bite-sized recaps tailored to the last section users stopped listening to.

Spotify’s decision to sell physical books through its app positions it as a competitor to major booksellers, including Amazon and Barnes & Noble. The company also recognizes that many readers still value physical books, and by offering both print and digital formats, Spotify is trying to turn itself into a one-stop shop for book lovers.

Spotify has partnered with Bookshop.org on the new offering, an online marketplace that supports local, independent bookstores. This partnership is great news for indie booksellers, as every purchase made via Spotify will directly benefit local book communities.

The ability to purchase physical books will roll out this spring and appear on audiobook pages in the app as a button labeled “Add to your bookshelf at home.” Clicking it takes users to Bookshop’s website, which handles the pricing, inventory, and shipping.

Techcrunch event

Boston, MA

|

June 23, 2026

To bridge the gap between formats, Spotify is also launching a feature called Page Match, which is currently available to premium subscribers and will roll out to all audiobook users by late February. The feature was initially spotted by Android Authority last month.

Spotify’s new Page Match feature lets users scan a page from a physical or e-book using their phone camera. The tool analyzes the page content and directs users to the exact spot in the audiobook. It’s powered by a combination of Spotify’s in-house and third-party computer vision and image scanning technologies.

When users want to switch to the audiobook, they can select the “Scan to Listen” button and click the “Scan to Read” button to return to the physical book, making it easy for users to pick up where they left off, whether they’re reading at home or switching to audio while on the go.

Page Match is currently available for most English-language titles, with plans for future expansion. There are now more than 500,000 titles on the platform.

In the two years since Spotify first introduced audiobooks, the platform has experienced significant growth. The company reported in October that the number of users listening to audiobooks rose 36% over the past year, and listening hours increased 37%. Plus, more than half of Spotify’s 281 million premium subscribers have engaged with an audiobook.

Spotify is expected to release its fourth-quarter earnings results February 10.

Tech

Google’s subscriptions rise in Q4 as YouTube pulls $60B in yearly revenue

Alphabet-owned YouTube’s subscription and ad revenue is trending upwards. The company on Wednesday said it now has 325 million paying users across Google One and YouTube Premium, up from 300 million three months earlier.

YouTube reported ad revenue increased 9% to $11.38 billion in the fourth quarter, but missed analysts’ average estimates of $11.84 billion. YouTube’s overall revenue, including ads and subscriptions, came in at $60 billion in the full financial year, up 17% compared to a year earlier.

The company said that YouTube’s $8 per month, ad-free premium tier is seeing strong traction, but didn’t specify any numbers. It added that YouTube Premium also saw strong growth.

Alphabet CEO Sundar Pichai said the company plans to flesh out its subscription offerings, especially to capitalize on its growing YouTube TV userbase. “We’ll soon launch new YouTube TV plans, bringing more choice and flexibility to subscribers with over 10 genre-specific packages,” he said.

YouTube Shorts recorded 200 billion average daily views in the quarter, the same as last year, but in some countries, ads on short-form video earn more than in-stream ads on a per-hour basis, the company said. Pichai also highlighted podcasts as a growing format, with viewers watching 700 million hours of podcasts from their TVs in October.

YouTube said that its AI features are seeing traction, and more than 1 million channels are using its AI creation tools. The company said that 20 million consumers used its Gemini-powered content discovery tool in December.

Tech

SNAK Venture Partners raises $50M fund to back vertical marketplaces

SNAK Venture Partners announced Wednesday the close of its oversubscribed $50 million debut fund, anchored by the investment firm Pritzker Group (founded by Illinois governor JB Pritzker and his brother, Tony).

SNAK founders Sonia Nagar and Adam Koopersmith worked at the firm and helped lead investments in companies like the auto marketplace Backlot Cars and TicketsNow (exited to Ticketmaster). The duo decided to break out on their own and, earlier this year, launched their firm to back digital marketplaces.

“It felt like the timing was right and there was support within the firm to go do this,” Nagar said.

The vision is that there is still so much to digitize, like in supply chain and construction, and this is the moment to strike because even holdout industries are more comfortable adopting new technology as fintech architecture advances.

“If you look at the biggest venture wins over the last decade,” she said, pointing to the likes of Uber, Instacart, and Airbnb, “those are five of the top 10 outcomes in venture.” As in those companies that raised billions from investors, went on to IPO, and returned millions to them.

“Most of those wins were in consumer, which tends to be faster-moving than large enterprises,” Nagar continued. “We think there’s a ton of white space to double down and focus on B2B marketplaces.” Looking specifically for the categories that haven’t yet digitized.

The firm has already invested in six companies, including Big Rentals and Repackify, focused on equipment rental and packaging logistics, respectively. Nagar said the firm hopes to overall write seed checks into at least 20 companies, at $1 million to $2 million a pop. She said they hope to deploy the entire fund within the next 3 to 4 years.

Techcrunch event

Boston, MA

|

June 23, 2026

Though many new funds are struggling to raise capital (and capital remains concentrated at the top), Nagar said she and Koopersmith were able to lean on their backgrounds when wooing LPs.

Nagar previously helped launch Amazon apparel back in 2009, and was head of mobile at RetailMeNot. Koopersmith, meanwhile, spent 20 years at Pritzker Group and serves on the board of various marketplace companies. At the same time, Nagar said that without Pritzker’s support, it would have been quite hard to raise this fund, especially in last year’s environment.

Other LPs in their fund include the State of Illinois Growth and Innovation Fund and executives from other marketplace companies, like Favor Delivery and RetailMeNot.

Nagar said the firm is also location-agnostic, recognizing that the still-hidden marketplaces may not be found only in Silicon Valley and New York City. “We’re finding these overlooked founders in places where maybe other funds aren’t looking,” she said.

SNAK is itself based in Chicago, which she said some LPs have questioned. “People perceive that as a disadvantage; we view it as an advantage,” she continued. “We can get to everybody very fast.”